The Intermediate Earning Income Course is designed for learners who want to explore advanced concepts related to earning income, including compensation packages, employee benefits, taxes, and career development. This course follows the National Standards for Financial Literacy and aims to help participants make informed career choices that align with their financial and personal goals.

Course Information

Learning Objectives:

- Understand the various forms of compensation and employee benefits.

- Evaluate both tangible and intangible job benefits and their impact on career choices.

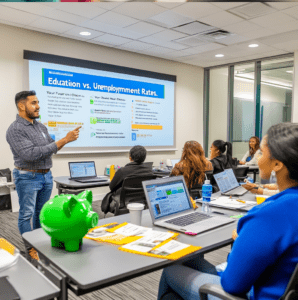

- Learn how education and training impact income potential and unemployment rates.

- Understand the impact of economic and labor market changes on employment and income.

- Understand the importance of taxes, tax deductions, and credits in financial planning.

- Explore different sources of retirement income and small business ownership as a source of income.